Tata Power Share Price | Tata Power Company Limited, one of India’s largest and most trusted power companies, generates electricity from various sources including thermal, hydro, solar and wind energy.

Known for its commitment to clean and sustainable energy, Tata Power plays a key role in India’s renewable energy development.

The company also focuses on innovative solutions such as electric vehicle charging and smart grids. Stay tuned for more information on Tata Power stock price targets for 2025, 2026 and 2030.

Fundamentals

- Market Cap – ₹1,19,393.86 Cr.

- P/E – 38.28

- P/B – 7.04

- Face Value – ₹1

- Div. Yield – 0.54%

- Book Value (TTM) – ₹53.09

- ROE – 15.13%

- ROCE – 13.46%

- 52 Week High – ₹494.85

- 52 Week Low – ₹338.50

Shareholdings

- Promoters – 46.9%

- FII – 9.2%

- DII – 17%

- Public – 27%

- Others – 0.0%

Tata Power Share Price Target (2025 to 2030)

| Tata Power Share Target Years | Share Price Targets |

|---|---|

| 2025 | ₹515 |

| 2026 | ₹587 |

| 2027 | ₹670 |

| 2028 | ₹765 |

| 2029 | ₹1008 |

| 2030 | ₹1157 |

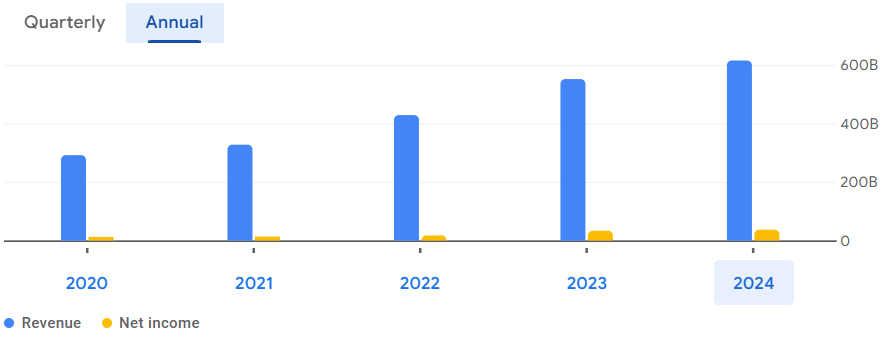

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 614.49B | 11.50% |

| Operating Expense | 116.44B | 8.95% |

| Net Income | 36.96B | 10.78% |

| Net Profit Margin | 6.02 | -0.50% |

| Earnings Per Share | 10.92 | 4.71% |

| EBITDA | 106.01B | 35.39% |

| Effective Tax Rate | 25.33% | — |

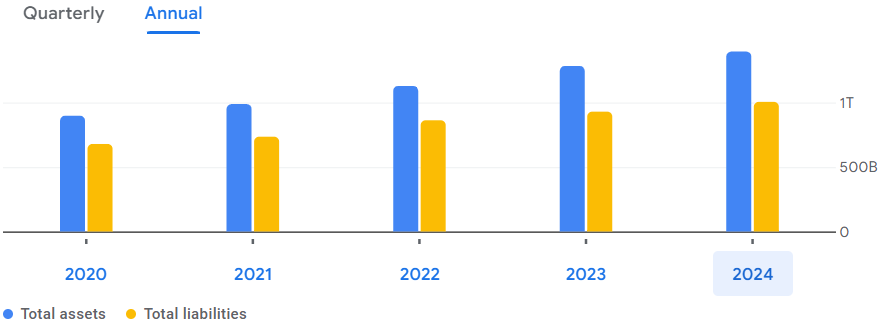

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 106.11B | -15.03% |

| Total Assets | 1.40T | 8.73% |

| Total Liabilities | 1.01T | 8.17% |

| Total Equity | 390.49B | — |

| Shares Outstanding | 3.20B | — |

| Price to Book | 3.56 | — |

| Return on Assets | 3.29% | — |

| Return on Capital | 4.83% | — |

Factors Affecting

- Renewable energy expansion: Tata Power’s investments in solar, wind and other renewable energy projects play a key role in determining its future growth and stock price.

- Government policies and incentives: Policies promoting renewable energy adoption, subsidies and incentives for green energy companies directly impact Tata Power’s performance.

- Electric vehicle (EV) ecosystem: The company’s ventures into EV charging infrastructure and collaborations in the EV space impact growth potential and investor sentiment.

- Electricity tariffs: Changes in electricity tariffs, for both renewable and conventional energy, impact Tata Power’s revenue and profitability.

- Regulatory environment: Compliance with energy sector regulations and environmental norms can impact operating costs and market sentiment.

- Energy demand growth: Rising electricity consumption due to urbanisation, industrial development and electrification of rural areas impacts Tata Power’s revenue potential.

- Global energy prices: Fluctuations in coal, oil and gas prices impact the cost structure of Tata Power’s thermal power generation.

- Technological advancement: Investments in energy storage, grid modernization, and smart energy solutions can attract investors and drive long-term growth.

- Diversification of portfolio: Tata Power’s focus on diversifying its energy portfolio, with a greater emphasis on renewable energy and reduced dependence on thermal energy, influences investor confidence.

- Debt levels and financial health: Efficient management of debt and improving profitability ratios are critical to sustaining long-term growth.

- Climate change commitments: Initiatives to align with global carbon neutrality goals and reduce emissions improve the company’s ESG (environmental, social, and governance) profile.

- Quarterly financial performance: Revenue growth, profit margins, and capacity utilization reported in earnings updates significantly impact stock prices.

- Competition: Activities of key competitors in the power generation and renewable energy sectors influence market dynamics and investor sentiment.

- Mergers and acquisitions: Strategic acquisitions or partnerships in renewable energy projects or emerging markets can drive future growth.

- Geopolitical Factors: Global and regional political stability and trade relations can indirectly impact Tata Power’s operations and stock performance.

Also Read: Tata Steel Share Price Target (2025 to 2030)

1 thought on “Tata Power Share Price Target (2025 to 2030)”