Taparia Tools Share Price Target 2025-2030 | Taparia Tools Limited is a leading Indian hand tool manufacturer, renowned for manufacturing high-quality tools for both domestic and industrial use. Established in 1969, the company has a wide range of products including spanners, pliers, screwdrivers and other hardware tools designed to meet international standards.

In this article, we will provide a comprehensive overview of Taparia Tools share price targets for the year 2025, 2026 and projections up to 2030. These forecasts will use various technical analysis approaches to give investors an informed view of potential future price fluctuations.

To predict the share price of Taparia Tools by the year 2030, a machine learning method will be used leveraging historical performance data. Over the past few years, Taparia Tools has shown consistent growth and remains a significant player in the Indian stock market.

Fundamentals

- Market Cap – ₹16.12 Cr.

- P/E – 0.14

- P/B – 0.05

- Face Value – ₹10

- Div. Yield – 376.65%

- Book Value (TTM) – ₹228.63

- ROE – 33.99%

- ROCE – 45.56%

- 52 Week High – ₹10.62

- 52 Week Low – ₹3.21

Shareholdings

- Promoters – 69.7%

- FII – 0%

- DII – 0%

- Public – 30.3%

- Others – 0%

Taparia Tools Share Price Target 2025-2030

| Taparia Tools Share Price Target Years | Share Targets |

|---|---|

| Taparia Tools Share Price Target 2025 | ₹17 |

| Taparia Tools Share Price Target 2026 | ₹23 |

| Taparia Tools Share Price Target 2027 | ₹30 |

| Taparia Tools Share Price Target 2028 | ₹37 |

| Taparia Tools Share Price Target 2029 | ₹46 |

| Taparia Tools Share Price Target 2030 | ₹54 |

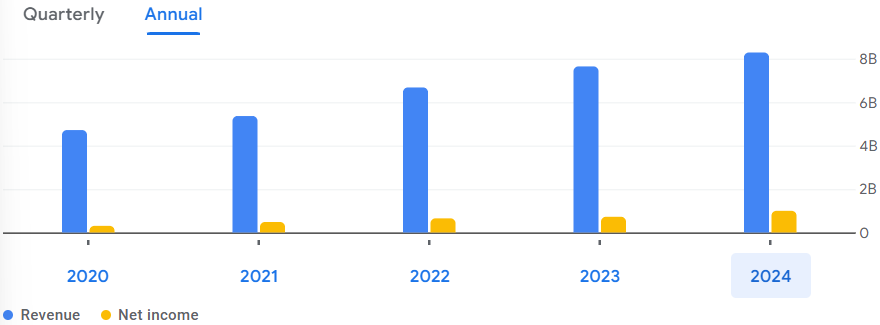

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 8.29B | 8.38% |

| Operating Expense | 2.16B | 12.45% |

| Net Income | 997.66M | 37.95% |

| Net Profit Margin | 12.04 | 27.27% |

| Earnings Per Share | — | — |

| EBITDA | 1.26B | 34.08% |

| Effective Tax Rate | 25.23% | — |

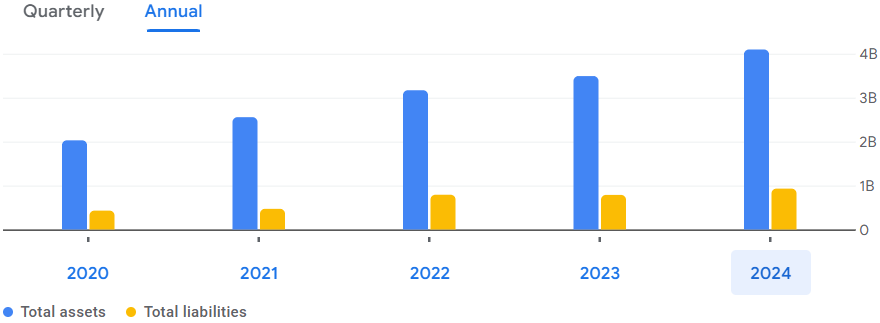

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 1.55B | 72.82% |

| Total Assets | 4.10B | 17.33% |

| Total Liabilities | 930.22M | 18.18% |

| Total Equity | 3.17B | — |

| Shares Outstanding | 15.18M | — |

| Price to Book | 0.05 | — |

| Return on Assets | 20.54% | — |

| Return on Capital | 26.51% | — |

Factors Affecting

- Economic Conditions:

- Global and Domestic Economic Growth: Economic expansion could increase the demand for industrial tools, which would positively impact Taparia Tools’ revenues.

- Inflation and Currency Rates: Inflation and currency exchange rate fluctuations could impact production costs and profitability.

- Industry Dynamics:

- Construction and Manufacturing Sector Trends: Growth in the construction and manufacturing sectors would drive the demand for hand tools.

- Raw Material Prices: Changes in the prices of steel and other raw materials used in manufacturing equipment could impact cost structures and margins.

- Company Performance:

- Financial Health: Investors will be keeping a close eye on key financial metrics such as revenue growth, profit margins, and cash flow.

- Technological Advancements: Investing in modern manufacturing processes and product innovation would be essential to maintain a competitive edge.

- Government Policies and Regulation:

- Import and Export Policies: Policies affecting trade and tariffs could impact raw material costs and the overall supply chain.

- Industry Regulations: Compliance with industry standards and regulations can impact operating costs and market reputation.

- Market Sentiment and Competition:

- Market Position: Taparia Tools’ ability to maintain and expand its market share in the face of competition will be critical to its stock price.

- Customer Relationships: Building and maintaining strong relationships with key customers across various geographies is critical to consistent revenue growth.

Also Read: Asian Granito Share Price Target 2025-2030

Pingback: Honasa Share Price | Target 2025 to 2030 - Experts Prediction