Olectra Greentech Share Price | Olectra Greentech Limited, a rising star in the electric mobility sector, focuses primarily on electric buses and charging solutions.

Founded in 2000 and part of the MEIL Group, the company is dedicated to promoting eco-friendly public transport in India. Olectra was founded to provide next-generation electric buses that reduce air pollution and dependence on fossil fuels.

Apart from electric buses, the company also manufactures composite insulators for electric power transmission1. Stay tuned for more information on Olectra Greentech share price targets for 2025, 2026, and 2030.

Fundamentals

- Market Cap – ₹11,442.05 Cr.

- P/E – 111.19

- P/B – 11.62

- Face Value – ₹4

- Div. Yield – 0.03%

- Book Value (TTM) – ₹119.98

- ROE – 8.33%

- ROCE – 14.87%

- 52 Week High – ₹2,222

- 52 Week Low – ₹1,240

Shareholdings

- Promoters – 50%

- FII – 5.7%

- DII – 0.3%

- Public – 44%

- Others – 0.0%

Olectra Greentech Share Price Target (2025 to 2030)

| Olectra Greentech Share Target Years | Share Price Targets |

|---|---|

| 2025 | ₹1860 |

| 2026 | ₹1912 |

| 2027 | ₹2005 |

| 2028 | ₹2191 |

| 2029 | ₹2220 |

| 2030 | ₹2368 |

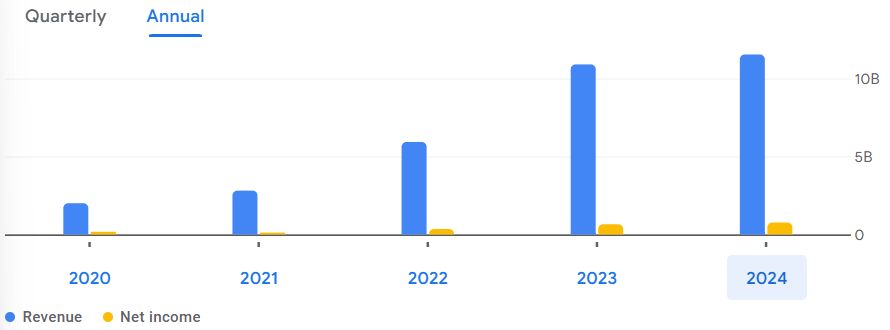

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 11.54B | 5.81% |

| Operating Expense | 1.97B | 22.81% |

| Net Income | 768.33M | 17.13% |

| Net Profit Margin | 6.66 | 10.82% |

| Earnings Per Share | 9.36 | 17.15% |

| EBITDA | 1.64B | 17.86% |

| Effective Tax Rate | 25.64% | — |

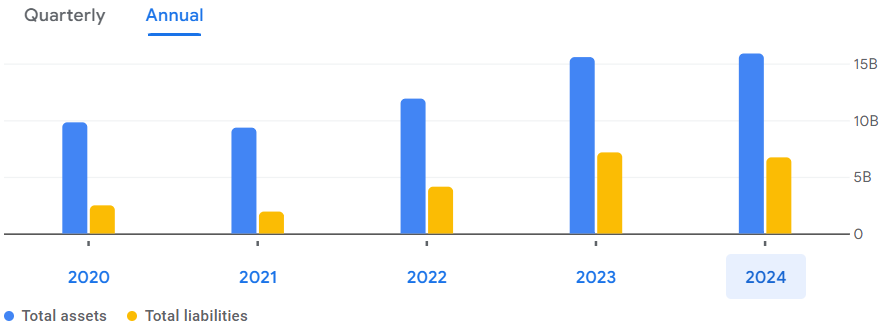

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 68.71M | 7.98% |

| Total Assets | 15.89B | 2.03% |

| Total Liabilities | 6.72B | -6.13% |

| Total Equity | 9.17B | — |

| Shares Outstanding | 82.08M | — |

| Price to Book | 12.57 | — |

| Return on Assets | 5.14% | — |

| Return on Capital | 8.03% | — |

Factors Affecting

- Electric vehicle (EV) market growth: As a leading electric bus manufacturer, the increasing trend of EV adoption in public transport significantly impacts Olectra Greentech’s revenue and share price.

- Government policies and subsidies: Policies such as FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) and state-level EV incentives drive demand for Olectra’s products, thereby driving growth.

- Infrastructure development: Investments in EV charging infrastructure, especially for public transport, directly impact Olectra Greentech’s market potential.

- Demand for sustainable transportation: Growing awareness and demand for eco-friendly transportation solutions create opportunities for Olectra’s expansion.

- Technological advancements: Development of advanced battery technologies and energy-efficient vehicles enhances Olectra’s competitiveness and profitability.

- Raw material costs: Fluctuations in prices of key materials such as lithium for batteries and other automotive components impact production costs.

- Collaborations and Partnerships: Strategic alliances with global players or government agencies can provide growth impetus and boost investor confidence.

- Global EV Trends: The performance of the EV sector worldwide, including demand for electric buses and trucks, has a huge impact on Olectra’s valuation.

- Quarterly Financial Performance: Earnings reports showing revenue growth, profit margins, and order book updates play a key role in influencing the stock price.

- Tender Wins and Contracts: Securing large government or private sector contracts for electric buses or related services impacts Olectra’s financial health and stock valuation.

- Competitive Landscape: Actions by competitors in the electric bus and vehicle segment such as Ashok Leyland and Tata Motors impact market dynamics and pricing power.

- Environmental Regulations: Increasing regulatory focus on reducing vehicular emissions drives demand for electric public transport solutions.

- Export Opportunities: Expanding into international markets with electric buses or related technologies can enhance revenue streams and investor outlook.

- Market sentiment and ESG focus: Positive sentiment about companies with strong environmental, social and governance (ESG) practices enhances Olectra’s market appeal.

- Economic conditions: Macroeconomic factors such as GDP growth, fuel price volatility and urbanisation trends indirectly impact Olectra’s growth prospects.

Also Read: Tata Power Share Price Target (2025 to 2030)

Pingback: Vodafone Idea Share Price Target (2025 to 2030)

Pingback: Wipro Share Price Target (2025 to 2030)