ITC Hotels Share Price | ITC Limited is one of India’s leading diversified companies, founded in 1910. Initially known for its tobacco products, ITC has expanded into various sectors including fast-moving consumer goods (FMCG), hotels, packaging, paperboards, and agribusiness. The company boasts popular brands such as Aashirvaad, Sunfeast, and Bingo.

We will provide detailed information about ITC’s share price targets for 2025, 2026 and projections up to 2030, using various technical analysis approaches to forecast long-term trends.

This will give you a concise but comprehensive overview of ITC Limited and its future prospects. Would you like to know more about a specific estimate for ITC’s share price?

Fundamentals

- Market Cap – ₹5,95,106.99 Cr.

- P/E – 28.91

- P/B – 8.14

- Face Value – ₹1

- Div. Yield – 3.16%

- Book Value (TTM) – ₹53.10

- ROE – 29.47%

- ROCE – 37.75%

- 52 Week Low – ₹399.35

- 52 Week High – ₹528.50

Shareholdings

- Promoters – 0%

- FII – 40.2%

- DII – 45.0%

- Public – 14.9%

- Others – 0%

ITC Hotels Share Price Target 2025 to 2030

| ITC Hotels Share Price Target Years | Share Targets |

|---|---|

| ITC Hotels Share Price Target 2025 | ₹573 |

| ITC Hotels Share Price Target 2026 | ₹695 |

| ITC Hotels Share Price Target 2027 | ₹829 |

| ITC Hotels Share Price Target 2028 | ₹951 |

| ITC Hotels Share Price Target 2029 | ₹1091 |

| ITC Hotels Share Price Target 2030 | ₹1202 |

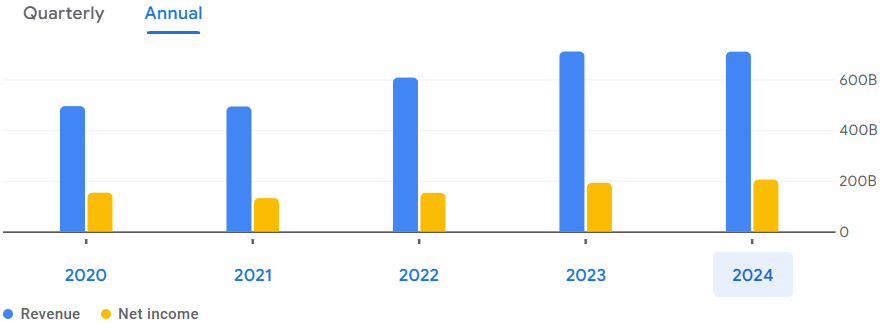

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 708.81B | -0.08% |

| Operating Expense | 183.14B | 6.40% |

| Net Income | 204.59B | 6.60% |

| Net Profit Margin | 28.86 | 6.69% |

| Earnings Per Share | 16.38 | 6.41% |

| EBITDA | 260.85B | 2.00% |

| Effective Tax Rate | 23.54% | — |

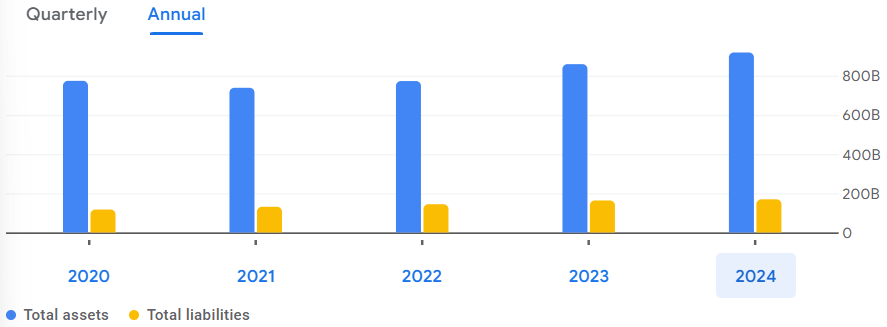

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 199.04B | -9.02% |

| Total Assets | 918.26B | 6.92% |

| Total Liabilities | 169.36B | 3.62% |

| Total Equity | 748.90B | — |

| Shares Outstanding | 12.48B | — |

| Price to Book | 7.30 | — |

| Return on Assets | 17.15% | — |

| Return on Capital | 21.01% | — |

Factors Affecting

- Economic Conditions

- Global and domestic economic growth: A thriving economy drives demand for luxury hotels and tourism services, which has a positive impact on ITC Hotels.

- Inflation rates and currency fluctuations: These affect ITC Hotels‘ operating costs and profitability.

- Industry Dynamics

- Tourism Trends: Growth in domestic and international travel directly drives demand for luxury accommodations.

- Competitive Performance: The performance of other major luxury hotel chains will affect ITC Hotels’ market share and pricing strategy.

- Company Performance

- Financial Health: Earnings reports and profit margins directly impact investor sentiment and stock prices.

- Expansion Plans: New projects, acquisitions, and hotel launches in key destinations contribute significantly to long-term growth.

- Regulatory Environment

- Government Policies: Policies promoting tourism, infrastructure development, and favorable regulations impact operational efficiency and profitability.

- Environmental regulations: ITC Hotels’ compliance with stringent environmental regulations, including its commitment to responsible luxury, can enhance its brand value.

Also Read: Honasa Share Price | Target 2025 to 2030 – Experts Prediction

Also Read: Here