Honasa Share Price | Honasa Consumer Limited, founded in 2016, is the parent company behind renowned personal care brands such as Mamaearth, The Derma Company and Aqualogica. Known for its natural, toxin-free, and eco-friendly products, the company caters to millennials and Gen Z with its innovative approach to skincare, haircare, and baby care. As of 24 January 2025, Honasa share price on NSE was ₹245.80.

Here, we will provide detailed information about Honasa Consumer Limited share price targets for 2025, 2026 to 2030. This analysis will include factors driving its growth, market trends and potential future performance based on its innovative product range and sustainable business model. Stay tuned to understand how Honasa stock may evolve in the coming years.

Fundamentals

- Market Cap – ₹7,904.59 Cr.

- P/E – 104.71

- P/B – 6.86

- Face Value – ₹10

- Div. Yield – 0%

- Book Value (TTM) – ₹35.49

- ROE – 0%

- ROCE – 18.86%

- 52 Week High – ₹546.50

- 52 Week Low – ₹222.15

Shareholdings

- Promoters – 35.03%

- FII – 15.44%

- DII – 15.40%

- Public – 31.06%

- Others – 3.06

Honasa Share Price Target 2025 to 2030

| Honasa Share Price Target Years | Share Targets |

|---|---|

| Honasa Share Price Target 2025 | ₹310 |

| Honasa Share Price Target 2026 | ₹430 |

| Honasa Share Price Target 2027 | ₹650 |

| Honasa Share Price Target 2028 | ₹770 |

| Honasa Share Price Target 2029 | ₹920 |

| Honasa Share Price Target 2030 | ₹1,170 |

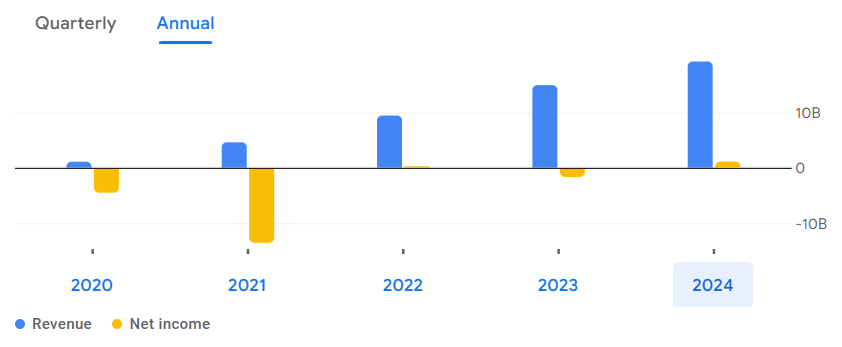

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 19.20B | 28.62% |

| Operating Expense | 12.28B | 18.36% |

| Net Income | 1.12B | 178.27% |

| Net Profit Margin | 5.82 | 160.82% |

| Earnings Per Share | 3.55 | — |

| EBITDA | 1.12B | 2,150.67% |

| Effective Tax Rate | 24.88% | — |

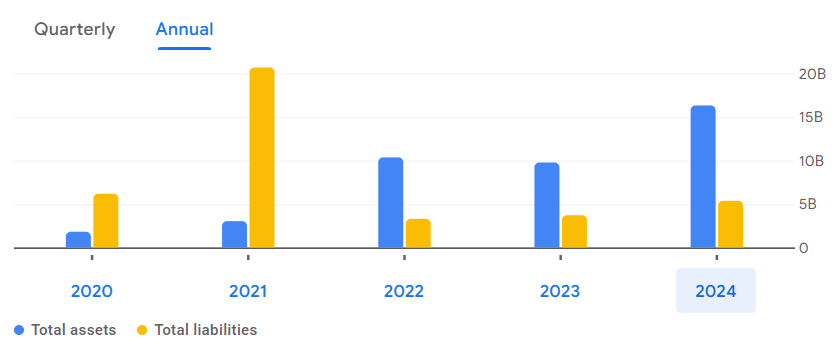

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 7.56B | 153.07% |

| Total Assets | 16.32B | 67.12% |

| Total Liabilities | 5.37B | 44.81% |

| Total Equity | 10.95B | — |

| Shares Outstanding | 324.24M | — |

| Price to Book | 7.34 | — |

| Return on Assets | 5.05% | — |

| Return on Capital | 6.84% | — |

Factors Affecting

- Brand Expansion and Product Innovation

- Honsa’s ability to consistently introduce innovative, eco-friendly, and toxin-free products under brands such as Mamaearth, The Derma Company, and Aqualogica will play a key role in driving consumer demand and market share.

- Consumer Demographics

- As millennials and Gen Z are increasingly preferring sustainable and natural products, Honsa’s focus on this audience will continue to drive its growth. However, it is important to remain relevant to their changing preferences.

- Marketing and Digital Presence

- Influencer marketing, social media campaigns, and leveraging e-commerce platforms will have a significant impact on brand visibility and revenue growth.

- Sustainability and ESG Practices

- With rising awareness about environmental, social, and governance (ESG) practices, Honsa’s eco-friendly packaging and sustainability initiatives will attract environmentally conscious investors and consumers.

- Competitive Landscape

- Entry of new players in the personal care segment or aggressive strategies by existing competitors could impact Honsa’s market position and growth trajectory.

Also Read: Taparia Tools Share Price Target 2025-2030

Pingback: ITC Hotels Share Price | Target 2025 to 2030 - Experts Prediction