Asian Granito Share Price Target 2025-2030 | ASIANTILES (Asian Granito India Limited) is a major player in the industrial sector, particularly within the building products and equipment industry.

This comprehensive post will examine ASIANTILES stock price targets for 2025, 2026, and projections up to 2030. Using various technical analysis approaches, we will provide long-term forecasts reaching out to 2030.

To forecast the price of ASIANTILES up to the year 2030, we will use a machine learning approach where the forecasted data is modeled on past performance. Recognized for its significant presence in the Indian stock market, Asian Granito India Limited has exhibited various trends over the past few years.

Fundamentals

- Market Cap – ₹900.36 Cr.

- P/E – 40.14

- P/B – 0.65

- Face Value – ₹10

- Div. Yield – 0%

- Book Value (TTM) – ₹93.78

- ROE – 2.39%

- ROCE – 3.91%

- 52 Week High – ₹98.19

- 52 Week Low – ₹50.90

Shareholdings

- Promoters – 33.5%

- FII – 1.6%

- DII – 0.2%

- Public – 64.7%

- Others – 0.0%

Asian Granito Share Price Target 2025-2030

| Asian Granito Share Price Target Years | Share Targets |

|---|---|

| Asian Granito Share Price Target 2025 | ₹85.92 |

| Asian Granito Share Price Target 2026 | ₹126.79 |

| Asian Granito Share Price Target 2027 | ₹187.11 |

| Asian Granito Share Price Target 2028 | ₹296.84 |

| Asian Granito Share Price Target 2029 | ₹470.96 |

| Asian Granito Share Price Target 2030 | ₹646.91 |

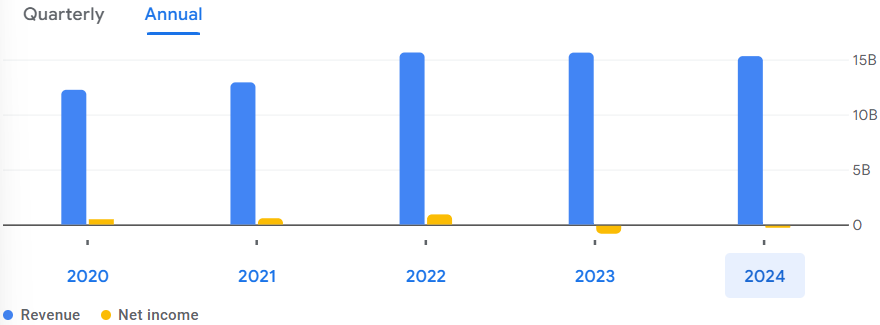

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 15.31B | -2.04% |

| Operating Expense | 3.55B | -5.04% |

| Net Income | -122.55M | 83.14% |

| Net Profit Margin | -0.80 | 82.80% |

| Earnings Per Share | — | — |

| EBITDA | 465.09M | 162.41% |

| Effective Tax Rate | -32.80% | — |

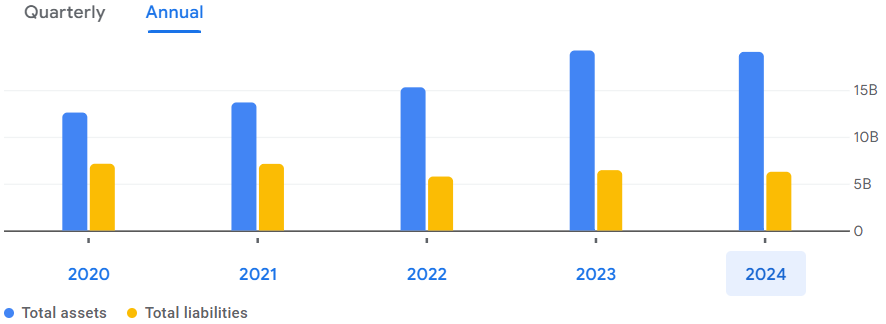

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 779.70M | -65.08% |

| Total Assets | 19.07B | -0.77% |

| Total Liabilities | 6.27B | -2.71% |

| Total Equity | 12.80B | — |

| Shares Outstanding | 126.75M | — |

| Price to Book | 0.63 | — |

| Return on Assets | 0.12% | — |

| Return on Capital | 0.15% | — |

Factors Affecting

- Economic Conditions

- Global and Domestic Economic Growth: Economic expansion may lead to an increase in demand for construction and interior products, which will have a positive impact on Asian Granito sales.

- Inflation and Currency Rates: Inflation and fluctuating currency rates may affect production costs and profitability.

- Industry Dynamics

- Construction and Real Estate Sector: Growth in the construction and real estate sectors will directly impact the demand for tiles and related products.

- Raw Material Prices: Fluctuations in the prices of raw materials such as clay and other chemicals may impact production costs.

- Company Performance

- Financial Performance: Revenue growth, profit margins and cash flow management will significantly impact investor sentiment and stock prices.

- Expansion Plans: Effective implementation of expansion plans and entry into new markets will be critical for sustainable growth.

- Government Policies and Regulation

- Housing Policies: Government policies related to housing and construction may influence market dynamics.

- Compliance and Regulation: Compliance with environmental regulations and standards can affect operating costs and the company’s reputation.

- Competitive Landscape

- Market Position: Asian Granito’s position relative to its competitors will affect its market share and profitability.

- Innovation and Design: Continuous innovation in products and designs will be key to maintaining a competitive edge.

Also Read: Dhampur Sugar Share Price Target 2025-2030

Pingback: Taparia Tools Share Price Target 2025-2030