Dhampur Sugar Share Price Target 2025-2030 | Dhampur Sugar (Dhampur Sugar Mills Ltd.) is part of the Consumer Protective sector, operating within the Confectionery industry

In this comprehensive outlook, we will examine Dhampur Sugar Mills Limited stock price targets for the year 2025, 2026, and estimates reaching 2030. Using various technical analysis approaches, we aim to provide long-term forecasts until 2030.

Forecasting the price of Dhampur Sugar Mills Limited until 2030 involves using a machine-learning approach where the forecasted data is based on historical performance. Dhampur Sugar Mills Limited, a significant player in the Indian stock market, has shown various trends over the past few years.

Fundamentals

- Market Cap – ₹989.97 Cr.

- P/E – 13.93

- P/B – 0.91

- Face Value – ₹10

- Div. Yield – 0%

- Book Value (TTM) – ₹165.54

- ROE – 12.46%

- ROCE – 12.44%

- 52 Week High – ₹268.55

- 52 Week Low – ₹122.70

Shareholdings

- Promoters – 49.1%

- FII – 2.1%

- DII – 0.5%

- Public – 48.3%

- Others – 0%

Dhampur Sugar Share Price Target 2025-2030

| Dhampur Sugar Share Price Target Years | Share Targets |

|---|---|

| Dhampur Sugar Share Price Target 2025 | ₹234.05 |

| Dhampur Sugar Share Price Target 2026 | ₹358.24 |

| Dhampur Sugar Share Price Target 2027 | ₹449.43 |

| Dhampur Sugar Share Price Target 2028 | ₹584.26 |

| Dhampur Sugar Share Price Target 2029 | ₹710.58 |

| Dhampur Sugar Share Price Target 2030 | ₹892.90 |

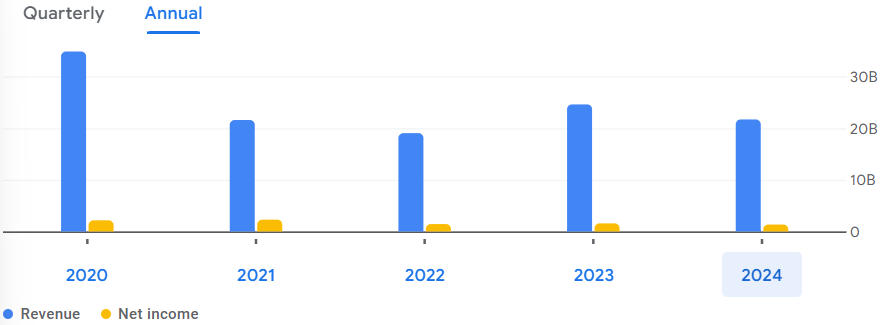

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 21.69B | -11.82% |

| Operating Expense | 3.23B | 8.93% |

| Net Income | 1.34B | -14.72% |

| Net Profit Margin | 6.19 | -3.28% |

| Earnings Per Share | 20.27 | -14.54% |

| EBITDA | 2.61B | -14.17% |

| Effective Tax Rate | 29.97% | — |

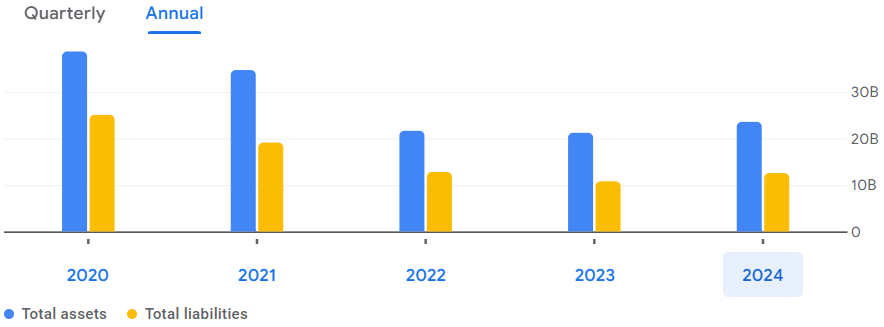

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 483.20M | 25.70% |

| Total Assets | 23.57B | 11.08% |

| Total Liabilities | 12.56B | 16.42% |

| Total Equity | 11.01B | — |

| Shares Outstanding | 65.39M | — |

| Price to Book | 0.91 | — |

| Return on Assets | 5.81% | — |

| Return on Capital | 6.72% | — |

Factors Affecting

- Economic Conditions:

- Global and Domestic Economic Growth: The performance of the global and Indian economy will significantly impact the demand for sugar and related by-products.

- Inflation and Currency Exchange Rates: Fluctuations in inflation and currency exchange rates can impact production costs and profitability.

- Industry Dynamics:

- Sugar Prices: The price of sugar in the domestic and international markets will be a major factor driving Dhampur Sugar’s revenues and profit margins.

- Government Policies: Policies related to sugar imports/exports, subsidies and minimum support prices will impact operations and profitability.

- Company Performance:

- Financial Health: Key financial metrics such as revenue growth, profit margins, debt levels and cash flows will have a direct impact on the stock price.

- Operational Efficiency: Increasing efficiency in production processes and cost management will be critical to maintaining profitability1.

- Technological Investments:

- Adoption of New Technologies: Investments in modern technology to improve production processes and increase yields can play a key role in performance and stock price.

- Diversification: Expanding product lines and venturing into related businesses such as ethanol production can enhance growth prospects.

- Market Dynamics:

- Competitive Landscape: The performance of other players in the sugar industry and related sectors will affect market share and competitive position.

- Seasonal Factors: Climatic conditions and monsoon patterns in India can affect sugarcane production and, consequently, Dhampur Sugar’s performance.

Also Read: Adani Wilmar – AWL Share Price Target (2025 to 2030)

Pingback: Asian Granito Share Price Target 2025-2030